Financial literacy is in short supply. Brands who lean into an education-first finance content marketing strategy can build lasting customer relationships, when done right.

Consumers are making a substantial investment when they choose to work with your financial institution. Outside of the financial commitment, the decision of which company to work with also requires a significant amount of time and research. This is true whether selecting an institution for banking, loans, or retirement funds.

As a marketer, it’s important to be proactive in answering key consumer questions to win their trust and business. Some questions our financial services clients are regularly addressing include:

- Which business offers the best rates?

- Can I solve all my financial needs in one place?

- What accounts and funds are best for me?

But, these questions are truly just scratching the surface. To win over audiences, you must build a robust, flexible finance content marketing strategy that:

- Simplifies communication between the business and consumers

- Delivers useful content in the most opportune areas

- Leans into innovation, fearlessly breaking the mold

Building a line of communication with finance content marketing

To persuade consumers to trust and invest in your financial services, you must understand their motivations, financial literacy and relationship with your brand. But don’t stop there.

Go more in-depth to find out what their research process looks like, understanding what and who impacts their financial decisions. Additionally, discover what channels they use to formulate an opinion about your financial brand. Are they watching financial channels on YouTube? Searching on Google to see if you’re on a list of top local banks? Reading brochures on the benefits of opening certain accounts?

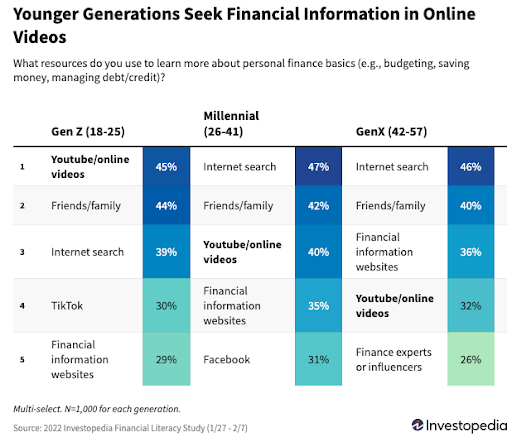

47% of consumers worldwide turn to their wealth manager or investment adviser when making important financial decisions, followed by educational resources from financial institutions (41%), whereas friends and family as well as social media are only at 25%. Yet, when it comes to making overall financial decisions, Gen-Z is turning to video while Millennials and Gen-X continue to first turn to search engines.

Figure out which channels your target demographics are turning to, create a unique communications strategy by product, and meet them where they are. Formulate a financial customer journey with your marketing to help answer their questions and ultimately persuade them to call, email, or fill out a contact form.

Leading with quality content

Depending on the risk of the financial decision, consumers may need a lot of time in the consideration phase. They’re weighing their options, researching and consulting with trusted sources. Regardless of the product or service line, sharing high quality educational content is your opportunity to show up early in the consumer journey.

Even if you’re just trying to get a consumer to open a checking account, taking the time to produce a high quality digital brochure or a video ad explaining your value creates an opportunity to build high lifetime value. The average consumer retains the same checking account for an average of 17 years.

Establish yourself as a helpful guide throughout the financial decision-making process, featuring your organization’s subject matter experts as authorities in the financial industry. Also, use consumer intel as the foundation for your content marketing strategy. Then create informative, empowering content personalized for your target audiences that addresses those top of mind questions and helps them feel in control of their finances.

Educating financial advisors vs end users

The process of creating and distributing content becomes slightly more complicated in a B2B2C marketing model. If a third-party business or individual is responsible for the final sale, you must arm them with information to best represent your value. With B2B content, you can be more technical and include common industry jargon. However, your B2C consumers need different materials. Lean into high-level content, providing enough information where the consumer understands the benefits without being overwhelmed or intimidated.

Link these two paths by creating a series of content around the most important topics for explaining your product and service value. This allows the consumer to interact with multiple, digestible pieces of content that guide their research and discovery process.

Then, create a two-pronged advertising strategy to amplify content in key channels that make sense to each respective audience. With financial advisers, perhaps it’s serving amplified content alongside well-known financial journals, television programs, and LinkedIn, whereas content amplified for consumers could appear on YouTube, Google, or even TikTok. Either way, it’s critical to create an omnichannel experience with multiple touchpoints that keep your brand top of mind.

Identifying the greatest opportunities

Even though you should be implementing an omnichannel experience, that doesn’t mean your strategy should be throwing dollars at the wall hoping something sticks. That’s especially true in terms of marketing channels and tactics. Use measurement tools, such as media mix modeling, to understand the channels driving the highest return in your campaigns. Then, align your most valuable, informative content with highly trusted channels. And finally, determine unique KPIs to define success and keep your marketing accountable.

Breaking the mold

It’s easy to get into a rhythm of what’s comfortable and familiar in your marketing. But, it’s important to consistently keep a pulse on what’s happening across the finance spectrum.

- What trends are impacting marketing execution?

- What matters to your customers today?

Based on these learnings, test a variety of content marketing executions. This can vary from your standard display banners to custom articles, podcast placements, email marketing – you name it. Begin building reach with expanded target audiences (achieving sufficient scale is key!) by using adjacent topics to your typical content. This will position your brand as a helpful thought leader.

Financial literacy is still lacking across much of the population, especially younger generations. Brands have a major opportunity to drive finance consumer leads through education – a pivotal, but often overlooked, part of the consumer journey.

For tips on how to incorporate a financial content strategy into a full-funnel digital marketing, view our Ultimate Guide to Financial Marketing.