How Financial Institutions Can Adapt to a Digital-First Marketplace

Consumers are making a substantial investment when they choose to work with your financial institution. Outside of the financial commitment itself, the decision of which company to work with also requires a significant amount of time and research. This is true whether selecting an institution for banking, loans, or retirement funds.

To win over finance customers, you must build a robust, flexible strategy that establishes trust, provides an open line of communication on preferred platforms, and simplifies the finance decision-making journey. Keep reading for Coegi’s how-to guide on financial services marketing.

In this guide you’ll learn how to:

-

- Capitalize on market opportunities

-

- Target and motivate financial consumers with personalized messaging

-

- Create an effective omnichannel financial marketing strategy

- Track, measure, and improve advertising performance

A strong audience strategy backed by a robust understanding of their behaviors, motivations, preferences, and media consumption will drive reduced media waste by ensuring your ads are being shown in the ideal places and with an effective message.

-Maggie Gotszling, Account Strategy Director

Key Digital Channels for Financial Marketing

During the COVID-19 pandemic, everyone – even late adopters – began exploring ways to conduct finances online. We saw a surge in usage of online bill pay, Apple Wallet, Venmo/PayPal, digital check deposits, investment apps, and more.

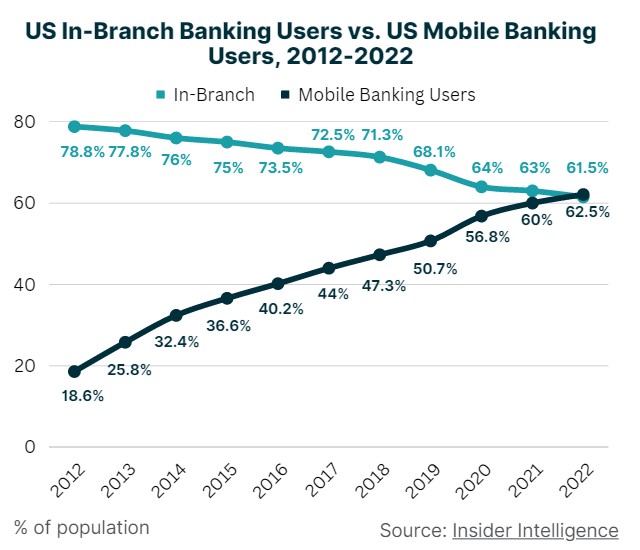

With this shift in behavior, the volume of physical banks is shrinking. From 2012-2021 there was a 16% decrease in US branches. On the other hand, there will be over 3.6B online banking users globally by 2024.

Changes in digital adoption are prevalent among both financial professionals and consumers across age groups. As a result, 87% of financial marketers increased their digital marketing budget in 2022.

Use the following digital channels to focus your dollars on the most cost-efficient and effective channels that align with a digital-minded consumer.

Video

Finance brands are realizing the value of video in driving awareness through storytelling, which is important for major financial decisions. Consumers are shifting more and more to video content. In fact, around 84% of consumer internet traffic is on video content. So use quality video content to educate your audiences, show your brand personality, and bring your message to life.

YouTube

YouTube is the preferred source of finance-related video content among Gen-Z. Additionally, one in three Millennials cited YouTube as their preferred source of investing and personal finance guidance.

Connected TV

Streaming TV received the highest investment of any digital channels by consumer banking and consumer finances brands in the past year, according to Pathmatics data.

Why are finance marketers leaning so heavily into CTV?

-

- High-impact video content on the largest screen in households

-

- Addressability with contextual and behavioral targeting

-

- More flexibility and affordability versus traditional TV

Social Video

Short-form videos on social media platforms typically receive higher engagement and promote better brand recall. This is why video ads are expected to account for 35% of social media ad spend in 2023. Use quick, straightforward video content to efficiently convey your brand message.

Paid Search

Search engines drive nearly all website traffic and are the third most popular source for consumer financial education behind families and banks themselves. It’s critical to show up as a top-ranking site on Google. Pair effective keyword bidding with strong website SEO to ensure your brand is visible at key points in the consumer journey.

Display

Display ads are a cost-effective option for building brand awareness. They can also drive consideration and lead generation through specific CTAs. We recommend using dynamic creative for personalized offers which drive measurable actions.

Native display ads are especially useful for targeting finance buyers when they are reading contextually relevant content. It can position your brand as an additional resource to the topic they are reading about without being intrusive.

Paid Social

59% of financial marketers expect to increase their social media marketing budget in 2022.

Why? Four out of five financial marketers gain new leads through social media.

Social media is useful in bringing your brand to life and building trust and authenticity with followers in an environment where they are active daily. It also goes a long way in driving new prospects and increasing customer lifetime value.

High Performing Social Channels for Financial Marketing:

LinkedIn has millions of active professionals with detailed targeting capabilities for reaching a business-focused target audience. On LinkedIn, individuals are more likely to engage in business activities. You can also use tactics like job title targeting to ensure you are reaching the right individuals.

Facebook and Instagram

Instagram is the most highly invested-in social channel for consumer banking, followed closely by Facebook. Together, these channels make up nearly half of all digital consumer banking ad spend. Lead generation ads on both platforms offer a reliable way to collect first-party data in exchange for educational content.

TikTok

No other social platform enables the potential virality or mass reach as quickly and easily as TikTok. Plus, there’s a huge niche on TikTok for financial content. Younger audiences looking to increase their financial literacy follow creators who post relatable and digestible finance content. There is a great opportunity for banks and finance brands to educate consumers and build awareness via influencer partnerships and paid advertising on TikTok.

Twitter is especially effective for targeting financially-minded individuals. 41% of users report that financial and business content on Twitter can impact their investment decisions. The platform has a very active crypto and fintech community. Members are consistently discussing the latest news and trends in the space. Align your brand with this content, trending hashtags or popular creators to capitalize on the opportunity Twitter offers.

Reddit often referred to as the “first page of the Internet,” is a discussion-based platform that allows advertisers to reach a very niche audience at a cost-efficient rate. It is most popular among the 18-34-year-old age group. This makes it a great option to reach younger generations with a financial interest. Look for relevant subreddits where your brand can show up as a helpful resource.

Local Partnerships

Regional finance brands need to be active in their communities. Local partnerships are a great way to establish that presence and boost brand affinity. For example, a regional bank could sponsor a professional sports team or non-profit. Even for national brands, it’s important to identify the key regions where you have the greatest traction and find partnerships to help amplify your brand.

Content Marketing and Publisher Partnerships

Less human interaction with advisors and representatives means your online content has to work harder. Thought leadership content can humanize your brand and help guide your customers through their financial journey. Through publisher partnerships, brands can establish authority in particular industry niches.

Digital-First, Not Digital-Only, Engagements

Despite the strengths of all these channels, digital tactics shouldn’t stand alone. Accounts opened in person have up to 10x higher balances after four months than those opened digitally. A positive physical onboarding is ideal to enhance customer lifetime value.

PWC reports, “Most consumers do still want to work with real bankers along with technology — especially during initial acquisition and onboarding activities — as long as it’s on their own terms”. So explore ways to create immersive experiences that blend physical and digital worlds for both customer service and advertising.

Creating an Omnichannel Financial Marketing Plan

Only 9% of customers say their bank offers an excellent digital customer experience. The top way you can improve the banking customer journey, according to BAI, is to improve the omnichannel experience. It’s easy to get absorbed in individual channels. However, this causes campaigns to turn from strategic to tactical quickly.

Instead, leverage a consumer-focused approach that determines who your most valuable audiences are and how you can best reach them.

Forward-thinking finance brands have an exciting opportunity to leverage the digital marketplace to their advantage. With a digital-first approach, audience personalization, and strategic targeting, you can reach your highest potential buyers with maximum efficiency.

As you continue to navigate these challenges, Coegi is here to guide you. Reach out to us at info@coegipartners.com for a strategy consultation to enhance your customers’ digital journey.